Introduction

Today, I am going to share a story of four owners. Each have their own unique objectives and goals. Each is at a different stage in their respective entrepreneurship journeys and each have different priorities in terms of action steps they need to take.

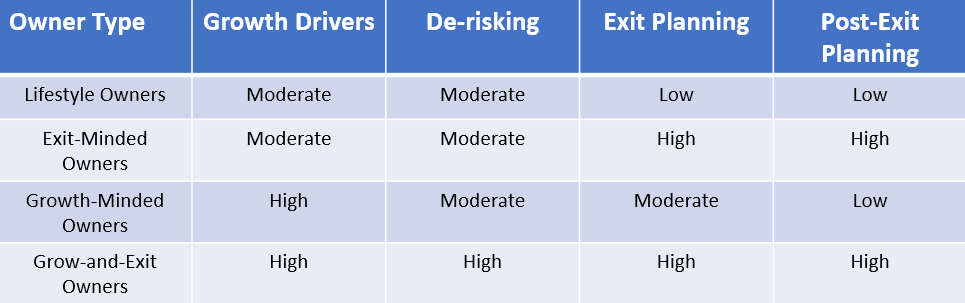

We discussed in an earlier article how exit planning needs to be addressed holistically. We at Velorum approach exit planning using the Value Acceleration Methodology, an approach that takes into account the “three legs of the stool”: financial readiness, business readiness, and personal readiness. Value Acceleration projects can last as short as six months or continuously, lasting many years. Every Value Acceleration project consists of an assessment of these four critical categories:

- Growth Value Drivers (What drivers help the company grow?);

- De-risking Value Drivers (What drivers lower the risk of the business?);

- Exit Planning (What exit options are available and what necessary steps are required to prepare for transition?); and

-

Post-Exit Planning (What are the owner’s goals beyond an exit?).

In light of these categories, let’s explore the four different types of owners and how a value acceleration project might differ for each.

Four Owners, Four Unique Projects

The Growth-Minded Owner

Jill is 47 years old and owns a middle market widget manufacturing business that she began 15 years ago. Jill is amazing at business development and operations but less so at other functions such as finance and human resources. Jill has a vague idea she would like to possibly exit her business in ten years or so but hasn’t made any concrete plans to do so. She is primarily interested in doubling the size of her business over the next five years. She hasn’t given any thought towards any post-exit objectives at this time.

How can a value acceleration project help Jill?

Jill is less interested in her exit planning options (although she might be interested in understanding more about them), but she is more focused on what can help her grow her business in the next few years. A value acceleration project for Jill would have heavier emphasis on revenue growth drivers (relating to growing sales and cash flows) but would also focus on how to systematize her company’s sales process. De-risking her business is a lower concern but something that still should be addressed in the next few years.

The Exit-Minded Owner

Phil owns a parts wholesaling business and is nearing 60 years in age. He has increasingly been growing tired in the last few years as business has become a grind to him. Phil has traditionally taken a lot of personal expenses out of the business and most of the Company’s assets have been fully depreciated for some time. Phil has some management that has been around for a few years. He thinks they are capable but he still tends to get involved a most day to day activities. Phil wants to sell his business in the next year as he wants to enjoy life up at the cottage and with his grandchildren while he is still healthy. He has never done a valuation of his business but he thinks his business “should be worth $5 million or so…”

A Value Acceleration project would be focused on identifying value drivers that can provide the biggest bang for his buck because Phil needs to improve his business in a short period of time. He likely won’t get to make all the changes he wants to make since he doesn’t have a long enough runway. In this case, Phil wants to sell his company to a third party, so he is not likely all that interested in exit options but post-exit planning is critically important to address since this may become either an impediment to any potential deal or a source of post-exit regret for Phil. Exit Now owners may find that because they did not spend enough time on value creation, the business is either not transferable or will not generate the multiples the owner hopes to get upon exit. It is not inconceivable that instead of selling his business, Phil and his company will decide to undergo further work in a Value Acceleration program, making a later attempt at a transition.

The Lifestyle Owner

Luke runs a business that provides professional services. Luke has a few assistants but for the most part, all business decisions are made by him. Luke makes good money and takes out a substantial amount of dividends each year. In addition, he runs a lot of personal expenses through the company. His primary mindset is on maximizing his cash distributions each year and minimizing his taxes. Luke has never spent much time thinking about selling his business, although he often wonders what it might be worth. In general, Luke is very happy with his current status in life.

First, Luke may not necessarily be interested in a Value Acceleration project because he is happy with the status quo and he feels there is no need for dramatic change. However, lifestyle owners such as Luke may shift over time to become either a growth-minded owner or a grow-and-exit type owner. The major impediment to Luke shifting into a different owner-type is that it requires commitment to change because growing and exiting will require both investment in time and money.

A Value Acceleration program for Luke would focus mainly on the value drivers since Luke’s primary objective would be on how to make his business transferable. Matters such as exit planning and post-exit planning could be discussed at a high-level, but Luke would be most interested in how he can sustainably making his life easier (separate himself more from the business), scale his business, and make ultimately it transferable.

The Grow And Exit Owner

Lisa is 55 and runs a light fixture business that has experienced moderate growth over the past few years. There is a layer of management that is capable but inexperienced. Lisa has plans to exit her business in the next five years either through a third-party sale or a transition to management. Lisa has an idea of what her business is worth but would like to find out more. She knows her business may not be optimized for sale and is curious about what things she should do over the next five or so years to improve her chances of a successful transition.

Because Lisa is interested in both growth and exiting from her business, a Value Acceleration program will encompass a deep dive into all four aspects of the program. She needs to grow her business in a defined time frame, de-risk her business and separate herself as owner from it, do a comprehensive exit plan including assessing her exit options (internal, external, or family transfer), and also start doing some preliminary post-exit planning. Because Lisa has time, she can prioritize her to-do list much more than a more exit-minded owner. This gives her the advantage that she can be more focused on truly accelerating the value of her business and making it more transferable. Lisa also has the flexibility to shift her focus during the Value Acceleration program if priorities change. In addition, if an unsolicited bidder approaches her in a few years, her business will be more valuable and transferable thus allowing her the luxury of being nimble when opportunities present themselves.

Putting It All Together

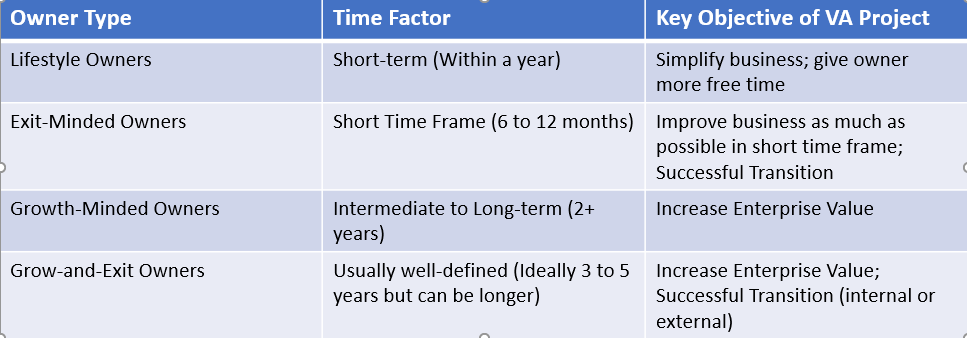

In the figures below, I have summarized how a Value Acceleration project differs for each type of owner. You’ll note that each owner type has different priorities attached. The Value Acceleration Methodology is flexible enough to address the unique needs of every owner. In Figure 1, we examine the owner types by category to illustrate how different owners will have different priorities. In Figure 2, I have summarized the key objectives of a Value Acceleration project for each owner along with the likely time frames for such a project, although these can vary based on each owner’s specific situation.

One last note I want to make is that you’ll note that de-risking a business is never a low priority, even for the lifestyle owner. Traditional exit planning has always included tax planning, estate planning, and insurance planning and is applicable to every type of business owner even lifestyle owners who might simply one day close their business. In cases where there are multiple shareholders, risk is multiplied and must be managed through comprehensive shareholder agreements and funded through adequate insurance.

Figure 1 – Owner Type By Category

Figure 2 – Owner Type by Objective and Time Horizon

Enjoy this article? Subscribe to our newsletter here.

Want to talk? Book a free appointment here.