Introduction

As North America opened up in the first quarter of 2022, the M&A market continues to be robust, although there are some significant trends to continue watching as we move forward in the year. I’ve summarized some of the key findings so far by showing some data from both AM&AA along with private equity data from GF Data®. Please note that this data uses averages of many transactions and specific valuation concerns related to your business (or your client’s business) can only be determined through a formal valuation process.

Key Findings

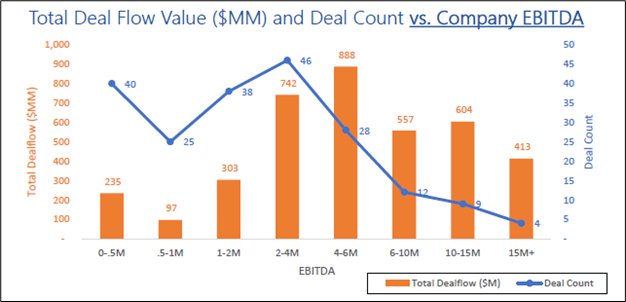

Exhibit 1

Source: AM&AA 2022 Q1 M&A Market Report

As can be seen from Exhibit 1 above, the deal flow in the Middle Market in 2021 was primarily centred on companies with EBITDA of $2 million to $15 million, with the highest amount of transactions occurring in the $2 million to $4 million space. There were still lots of companies under $500 thousand in EBITDA which comprised the “main street” sector of the market. The $4 million to $6 million EBITDA segment was the highest in terms of deal flow. This can partially be attributable to the number of private equity firms and buyer groups seeking out attractive businesses in the Lower Middle Market.

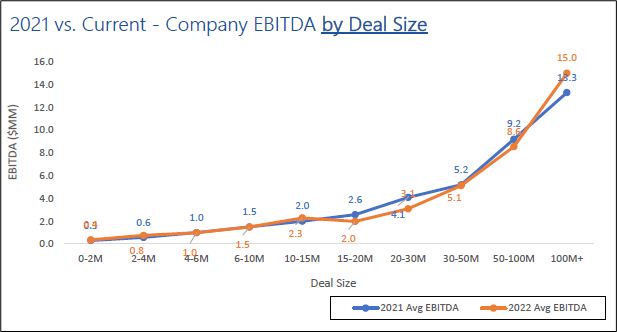

Exhibit 2

Source: AM&AA 2022 Q1 M&A Market Report

In Exhibit 2 above, we can see that the relationship between deal size and EBITDA in dollar terms is not a linear one but rather exponential. A clear pivot can be seen once we get past an Enterprise Value of $20 million. Businesses with EBITDA of $5 million or greater will attract the largest number of buyers with the highest multiples.

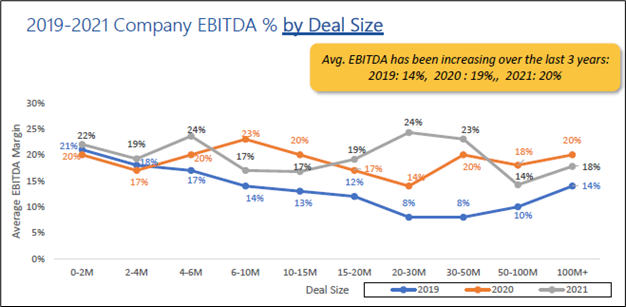

Exhibit 3

Source: AM&AA 2022 Q1 M&A Market Report

Exhibit 3 shows that EBITDA % (that is the percentage of EBITDA to revenues in a year) has, on average, steadily increased since 2019. In 2021, the average EBITDA % was 20% compared to only 14% in 2019. This metric is important because to attract prospective purchasers, businesses need to strive to be above-average, if not best-in-class.

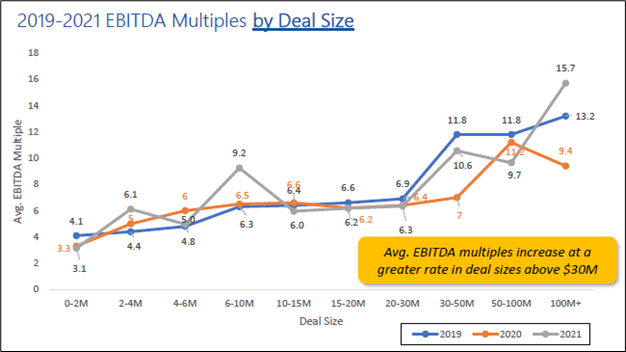

Exhibit 4

Source: AM&AA 2022 Q1 M&A Market Report

Exhibit 4 shows the relationship between EBITDA multiples and deal size. While there are some elements of noise in this data, it can be seen that multiples move upwards not in a linear fashion but rather in steps. In general, “main street” businesses surveyed sold in the 3x-4x range. Lower Middle Market (above $6 million in Enterprise Value) transacted at multiples of six or so, while truly Middle Market transactions could see multiple rise north of 10x EBITDA. This again demonstrates the value of growth planning when you can not only increase EBITDA but the multiple as well, resulting in a multiplication effect on Enterprise Value.

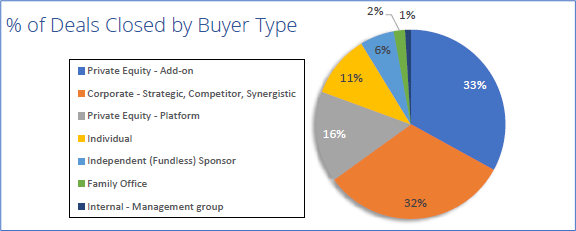

Exhibit 5

Source: AM&AA 2022 Q1 M&A Market Report

In Exhibit 5 above, we can see that nearly two-thirds of deals related to either private equity add-ons or corporate strategic/synergistic purchases. This means that two-thirds of deals in 2021 presented targets with the opportunity of being purchased at a premium compared to financial buyers. This highlights the importance of developing a strategy ahead of time to align the company with developing trends.

Other Trends

- In the GF Data® May 2022 report, companies with above average financials sold to private equity with a premium of 22% in 2022 so far (30% in 2021) and a premium of 15% over the course of the past 20 years. This demonstrates again that having above average metrics will result in higher selling multiples. This is an important aspect of exit planning that should be considered since it is a major driver of valuation.

- Private equity multiples have been trending upwards for the last four consecutive quarters.

-

Ownership by a PE Group or institutional investors achieved higher multiples versus family or individual ownership. Perhaps this can be attributable to the power of professionalizing a business, a key asset that institutional investors can bring to the table.

Interested in the full report? Send me an email at admin [at] velorum.ca and I would be happy to send a complimentary copy.

Enjoy this article? Subscribe to our newsletter here.

Want to talk? Book a free appointment here.