Introduction

In my last article, I spoke about how the absolute size of your cash flows mattered when it came to the potential multiple your business could achieve on the market. In this article, we will explore how timing your entry into the marketplace is also important when it comes to maximizing your leverage as a seller.

Timing a Buyer’s versus Seller’s Market

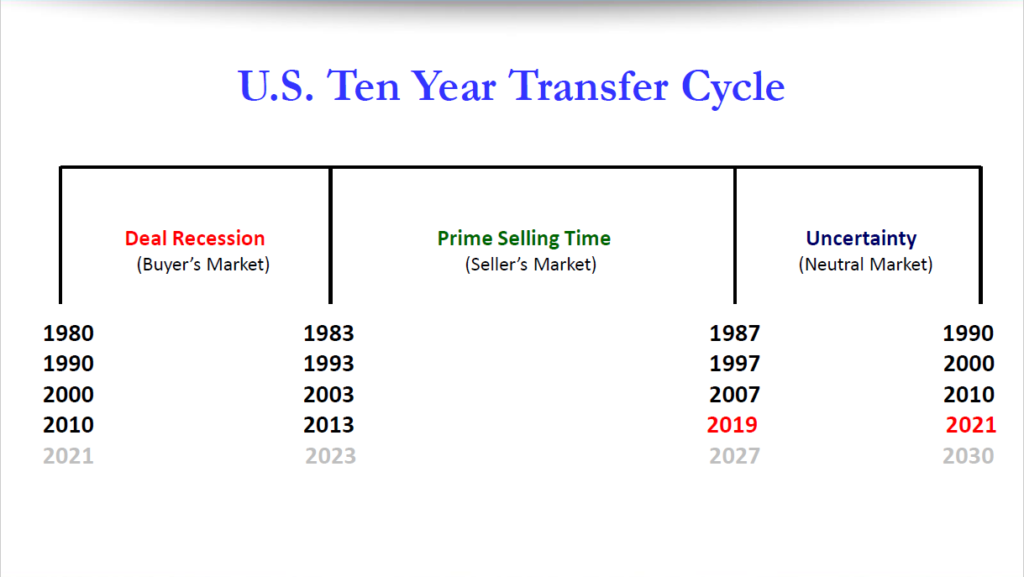

In Exhibit 1 below (courtesy of the Association of M&A Advisors), we examine three distinct periods that comprise every M&A cycle: a buyer’s market, a seller’s market, and a period of market uncertainty.

Exhibit 1 – Ten Year Transfer Cycle

Source: AM&AA

Buyer’s Market—Attractive Multiples and High Growth Rates

First, there is a buyer’s market. This represents a period of time when buyer’s have the upper hand over sellers. This period usually occurs in the middle of an economic slowdown and during the early phases of the economic recovery. Because uncertainty in this period is high, multiples are often relatively lower compared to more robust times. To prospective buyers, this is a good thing. The growth rates in this period can be high for companies with strong fundamentals and because the economy is emerging from a recession, it is likely that some competing companies fell by the wayside at the end of the last economic cycle. This removes some potential competitors and allows surviving companies the opportunity to make more money, at least in the short term before new market participants emerge. This phase traditionally lasts about two to three years.

Seller’s Market—Growth & Multiple Expansion

In the next phase, the advantage moves into the corner of sellers. This is where the “goldilocks economy” emerges and the angst from the previous recession has finally worn off. Fear has been replaced first with optimism and then later, transform into euphoria. During this phase, prospective buyers get squeezed since the companies they are seeking are both experiencing growing cash flows along with expanding multiples. Thus, the cost to purchase every dollar of cash flow becomes progressively more expensive over time. For sellers with high quality and growing enterprises, this period is the optimal time to execute an exit. Even businesses with lesser fundamentals may sell well near the end of this phase. Historically, this period usually lasts anywhere from four to six years.

Uncertain Market & Crisis—Volume Declines & Good Deals Harder to Find

The last phase is the period of uncertainty. This phase may start off with strong economic metrics but the prices on businesses may have become prohibitively expensive. Businesses with poor fundamentals are suddenly being examined with increasing scrutiny and skepticism. This uncertainty may manifest itself in terms of lower volume of deals as good deals become harder to find for buyers, or the number of interested buyers dries up. Often, during this period of uncertainty and declining fundamentals, a crisis will occur. The nature of the crisis will change in each cycle, but it is during this time that the vulnerability of certain companies and weakening fundamentals is exposed, thus resulting in an economic slowdown. During this period of time, weaker companies may either go bankrupt, require restructuring, or be bought out at pennies on the dollar if turnaround buyers can be found. At some point, maximum pessimism is reached and fundamentals slowly begin to improve. This phase lasts about two to three years and ultimately leads to a buyer’s market, where the cycle begins anew.

History Doesn’t Repeat But It Often Rhymes

As seen in Exhibit 1, these cycles have repeated over the decades and the total cycle usually lasts about ten years from beginning to end. We have seen crises pop up near the end of almost every decade since the 70s. This leads to a buyer’s market in the early portions of every decade, a strong seller’s market in the middle of the decade, followed inevitably by uncertainty as the decade comes to a close. In the last cycle, the pandemic didn’t impact North America until March 2020, but there had definitely been an uncertain market in the intervening months as reasonable deals were increasingly hard to find.

As Mark Twain said, history doesn’t repeat itself but it often rhymes. While no one knows the future, right now it appears we may be in the early stages of a recovery. This means 2021 through 2023 may be more favourable to savvy buyers with the financial wherewithal to buy solid businesses. Once we get to late 2023 and early 2024, hopefully the pandemic angst will have dissipated and a seller’s market will have returned. For those owners engaging in their own exit planning journey, this suggests that the timing may be quite favourable for their ultimate transition at this time. And if that is the case, the time to start planning, if you have not started already, is now. Remember that waiting too long may result in you selling into the next period of uncertainty when pricing and transactional volume may not work in your favour. Adequate exit planning and value creation take time, so hesitation on this front may ultimately cost you down the road.

Parting Thoughts

Some important last thoughts:

- We know from examining transactions during the last year or so that high quality businesses with sustainable growth and transferable value will sell (and may even get a good multiple), however, it may just take longer to sell.

- If you are currently undergoing a value acceleration and exit planning program, use this info to re-calibrate your intended exit timing.

- If you have not started your growth and exit planning journey yet, reach out to us today to begin a discussion about how you can successfully grow and transition your business. We will help you plan and then execute that transition.

Enjoy this article? Subscribe to our newsletter here!